Embracing subscription-based business models has become the ultimate goal for both aspiring entrepreneurs and established corporate behemoths. Maximizing revenue by securing multiple payments from each client effectively replicates sales without the burden of extra work.

In this article, we will show you how to accept recurring payments as a business owner. To do that, you don't need any coding experience, permissions or highly costly systems.

You only need a custom form connected to payment solutions. Here's how to organize the entire process:

Create A Payment Form For Your Website

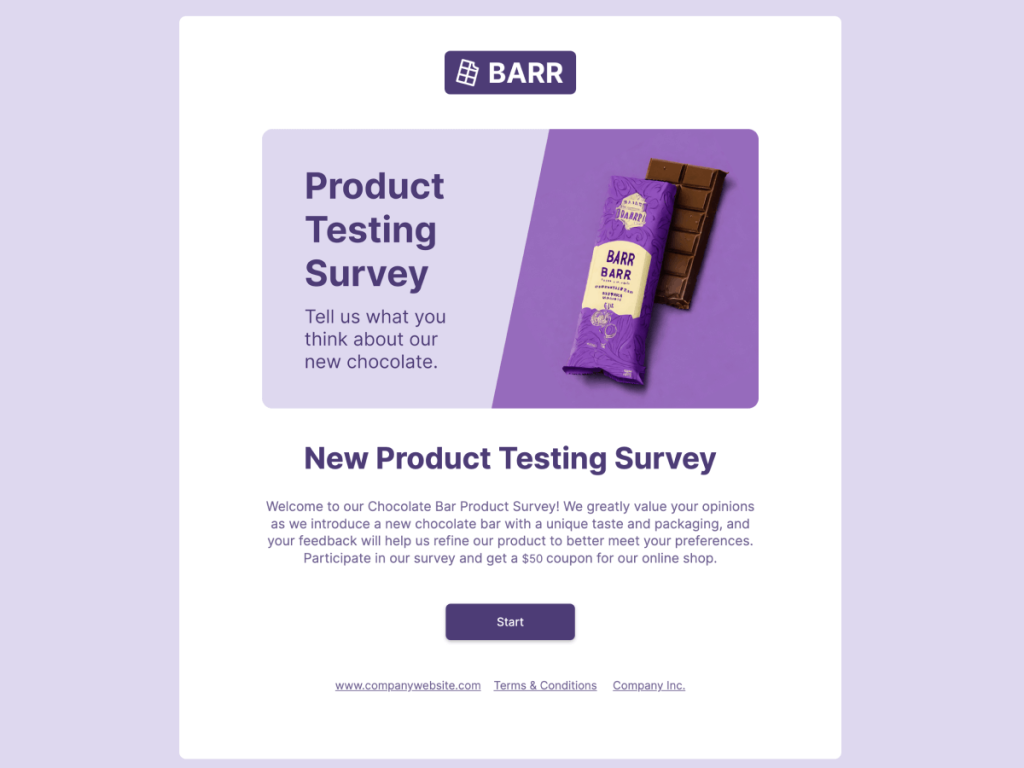

involve.me offers pre-designed templates you can customize by adding your own branding, content elements, and logic. You can embed the form right into your website, just like in this example below:

To create a similar online payment form using involve.me and connect a payment tool of your choice, follow these six steps:

1. Customize the Template

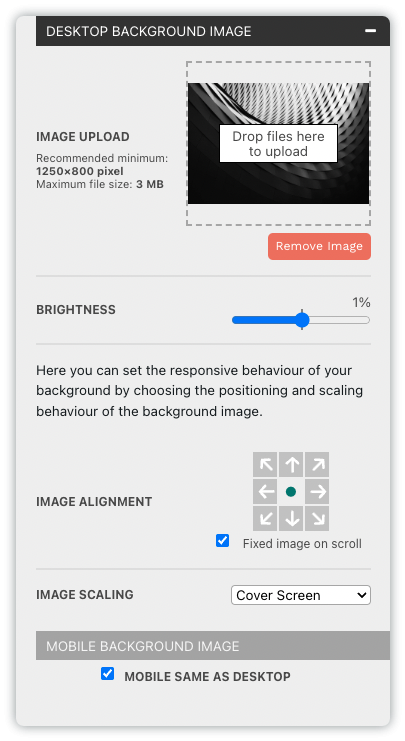

Include interactive elements like multiple-choice questions, text fields, payment details, checkboxes, and even custom calculators for dynamic pricing. For branding, you can adjust the form's appearance by tweaking colors, adding banner images, customizing buttons, and ensuring a consistent typography with your brand's fonts.

Create Payment Forms For Your Website

Choose a customisable template

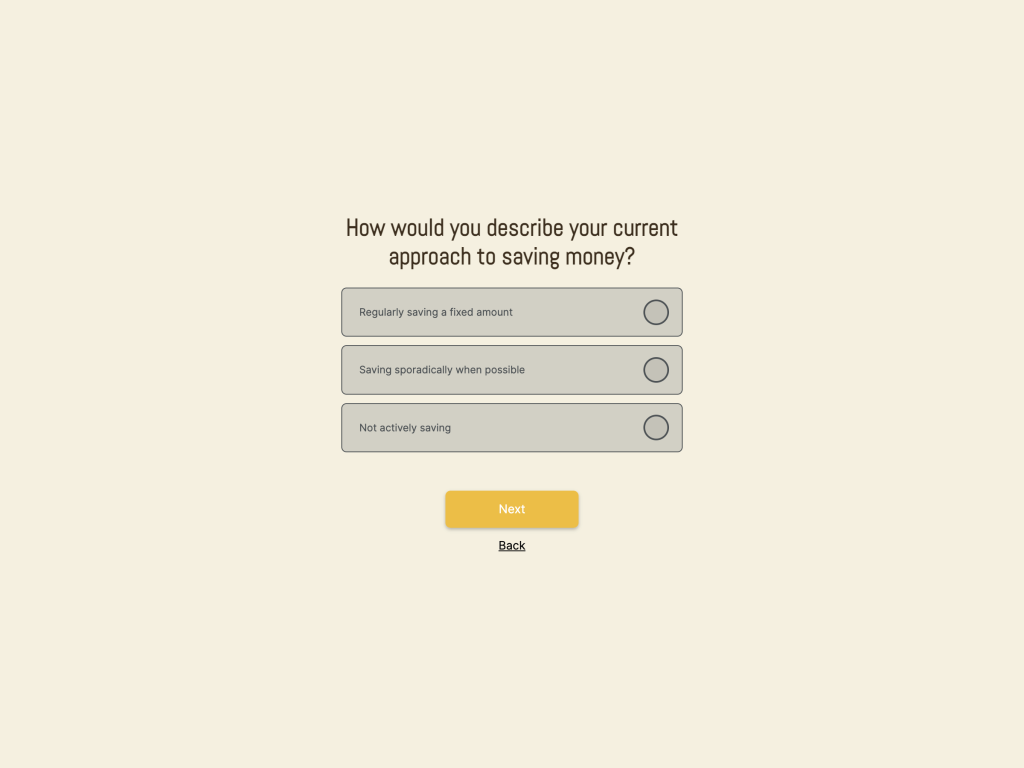

Market Research Survey for Finance Template

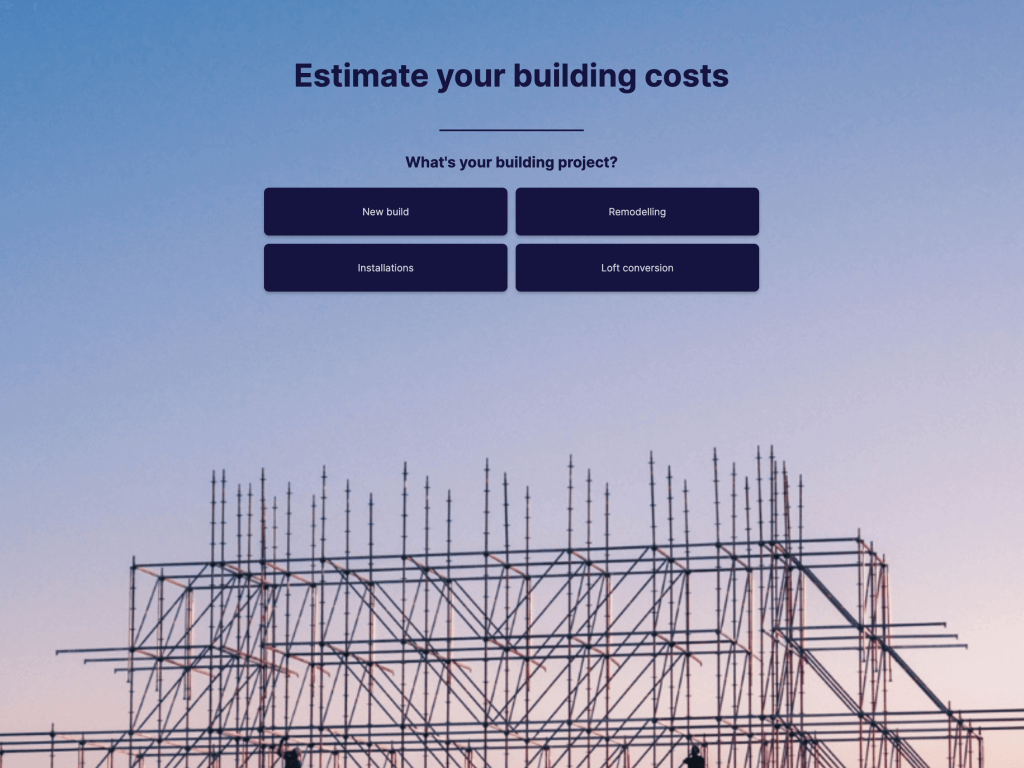

Building Cost Calculator Template

Request Collection Form for Real Estate Template

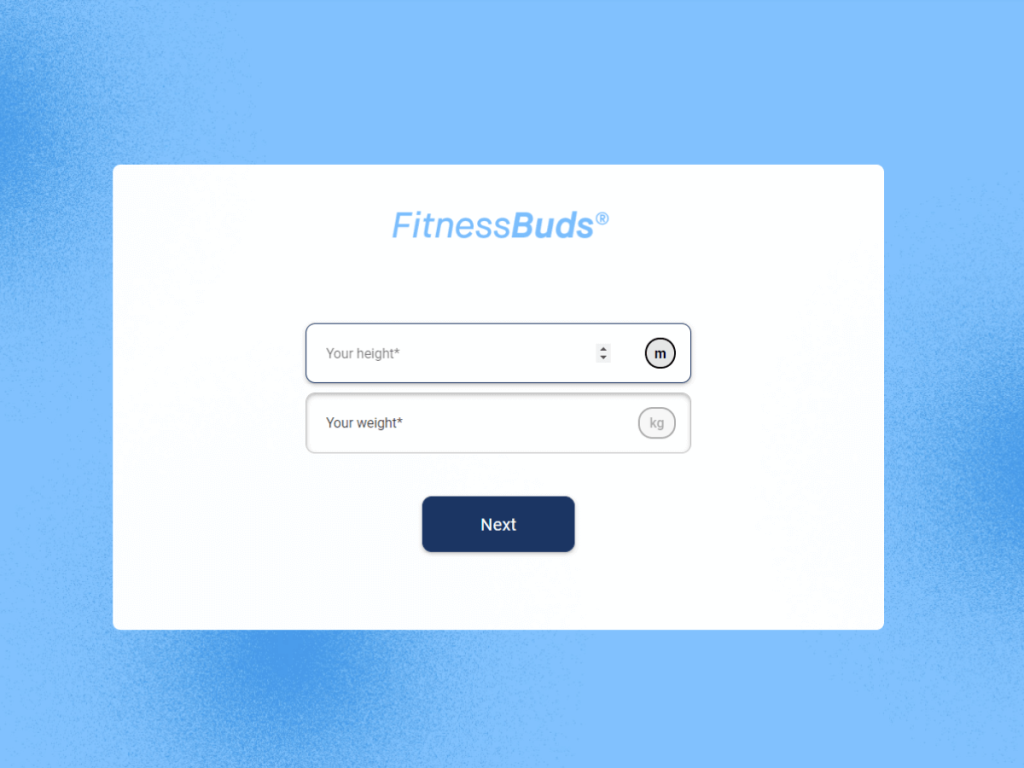

Fitness App Onboarding Funnel Template

Download E-Book Template

Discounted Purchase Template

2. Select a Payment Method

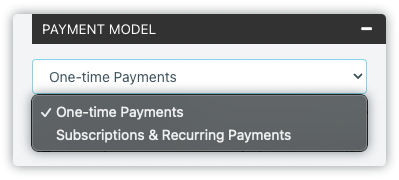

Add "Collect payments" content elements to your form. Choose between-one-time payments or subscription plan/recurring payments. Connect a payment processor, such as Paypal, Stripe or Square.

Payment Processors Available

| One-time Payments | Subscriptions & Recurring Payments |

Credit Card and Debit Card | Stripe, Square | Stripe, Square |

Pay via PAYPAL | Paypal | Paypal |

EPS | Stripe | Not Available |

iDEAL ACCOUNT | Stripe | Not Available |

SEPA DIRECT ACCOUNT | Stripe | Not Available |

Google Pay / Apple Pay | Stripe, Square | Not Available |

About transaction fees:

EPS, iDEAL, and SEPA transactions are processed in the Euro currency

EPS minimum transaction is €0.50

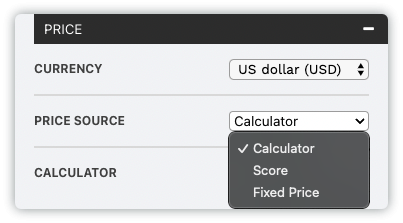

Select your preferred payment method, currency and decide on fixed or dynamic pricing.

3. Establish Recurring Payments

Select recurring payments from the "Payment Model" dropdown menu. It's crucial to also specify the currency and the source of pricing.

Fixed Price: This option ensures a consistent, unchanging amount for every user, simplifying the payment processing.

Score: If you prefer dynamic pricing based on user responses, you can opt for the "Score" source, which computes the total score on your page. This method uses the "by value" score type, aggregating values from questions with the "individual scoring" option. Importantly, you don't need a separate score element on the same page for this to work effectively.

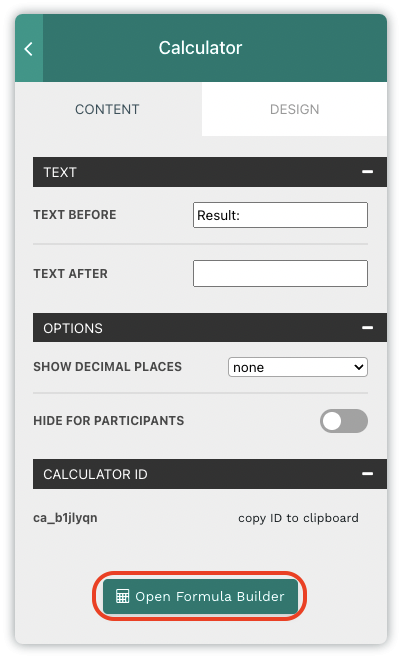

Calculator: For more complex and customizable pricing calculations, you can select the "Calculator" source. This relies on the result of a calculator element placed on the same page. After adding the calculator element, it becomes available for selection in the dropdown menu, allowing you to create intricate pricing models.

Good to know: A calculator element will save hours of manual work for your customer support teams, as customers will be able to calculate the price on their own.

4. Implement Dynamic Pricing

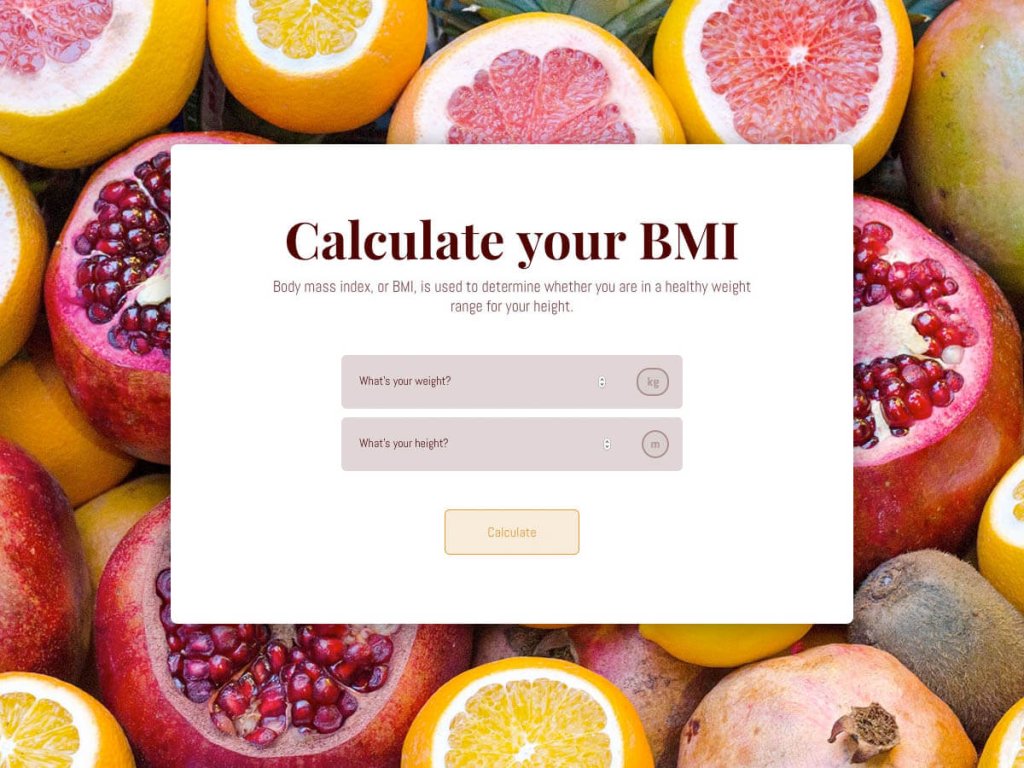

Create dynamic pricing (variable payment) for products by adding a custom calculator. Choose the calculator element, define variables (e.g., size, color, quantity), assign values to variable options, set pricing formulas (use our AI formula builder for complex formulas) and payment terms, and display the calculated price based on user selections.

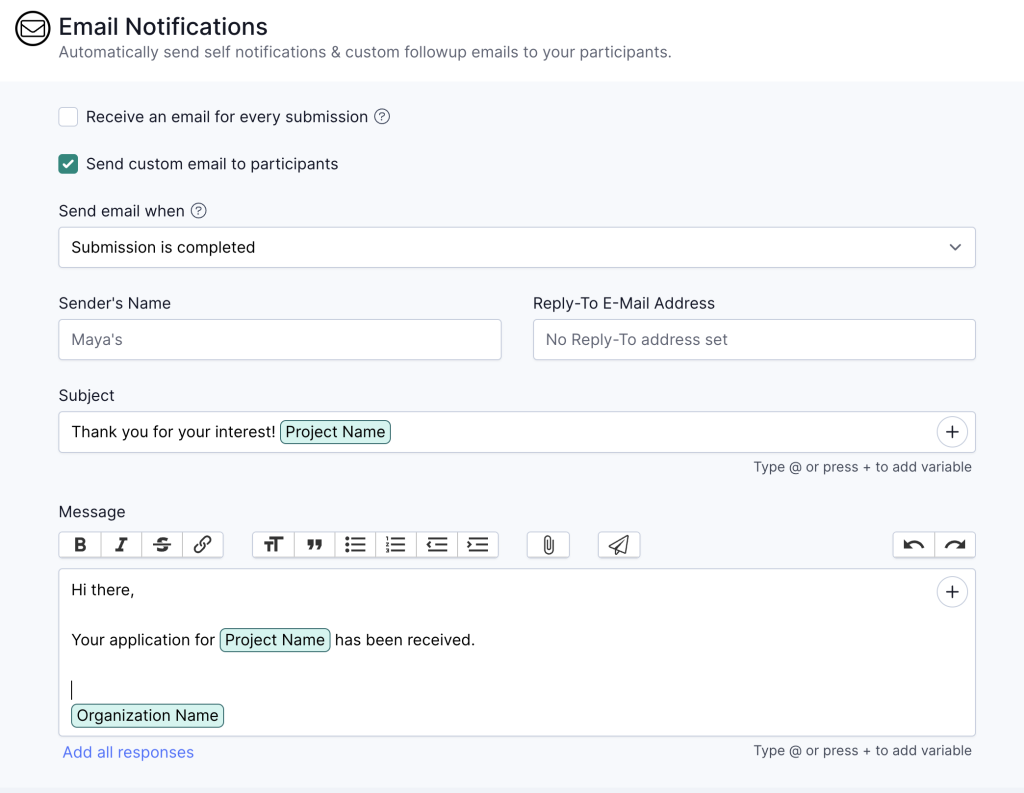

5. Send a Custom Email

Sending a custom email after a successful payment via form can significantly enhance the billing experience for your customers. This tailored email allows you to provide subscription details that empower customers to make informed decisions regarding their first-time recurring payments.

Navigate to the 'Configure' menu and select 'Email Notifications.'

Opt for the 'Send custom email to participant' option and proceed to compose the confirmation message.

Share insights into the billing logic, payment plan/ billing frequency to establish transparency. This proactive approach not only streamlines the billing experience but also ensures that customers are well-prepared for their financial commitments.

Pro Tip: You may also want to share product details, such as the estimated business days for delivery. In this case, we recommend integrating your payment form with email marketing tools such as Brevo, Mailchimp, HubSpot, and others.

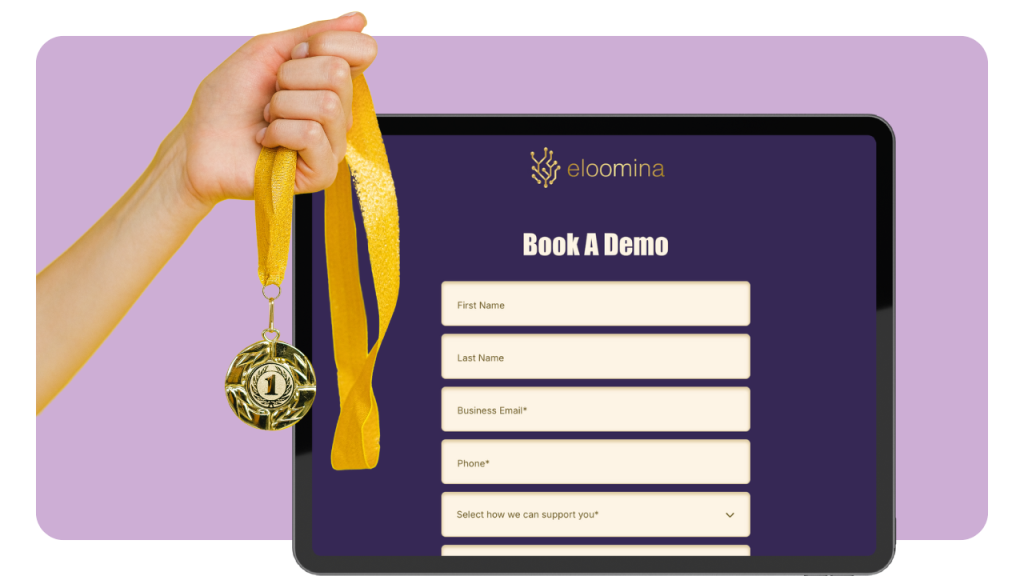

6. Publish & Share Your Payment Form

After completing and designing the form, publish it. Share the link on social media, in emails, or embed it on your website's checkout page. You can change the payment link.

Thanks to involve.me, your payment form will look the same on both desktop and mobile devices.

7. See Your Payments in the Analytics

Track paid form submissions in the project's analytics, specifically under the "Payments" tab. Get details on automatic payments , currency, and payment platform if users click the "pay" button.

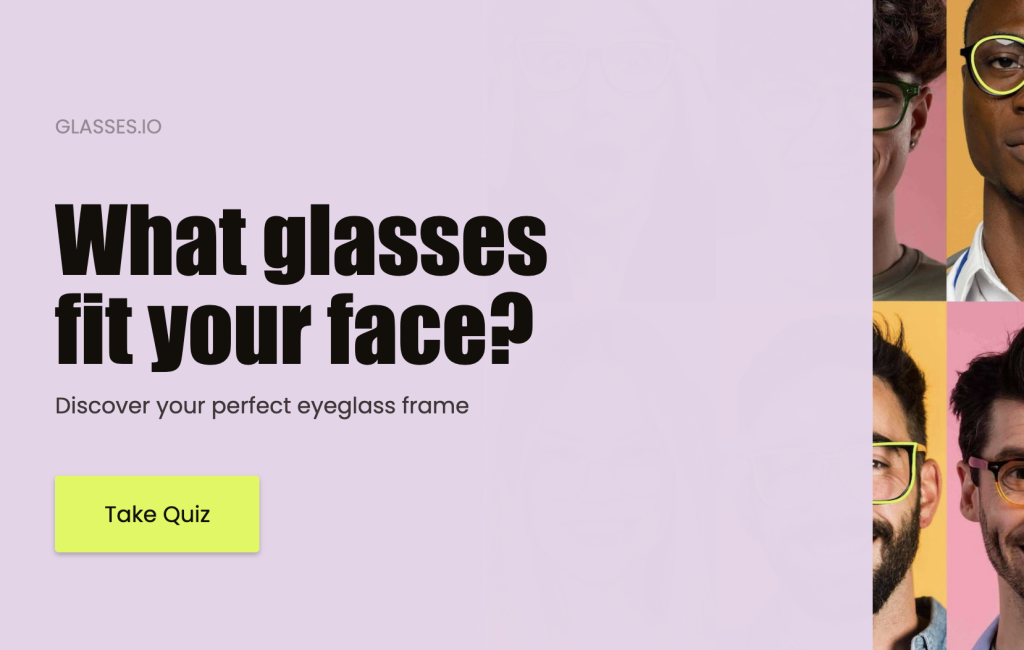

Mega Tip: To boost payment form conversions, provide product recommendations to guide your customers.

Select products to highlight and create questions and answers that direct users to these products. This helps customers find the right products and streamlines the user experience. You can create product recommendation form with involve.me and set up recurring payments as well.

product recommendation quiz

Understanding Recurring Payment Models

When it comes to accepting recurring payments, understanding the different recurring payment models available is important. Businesses can choose from several models to best suit their products or services:

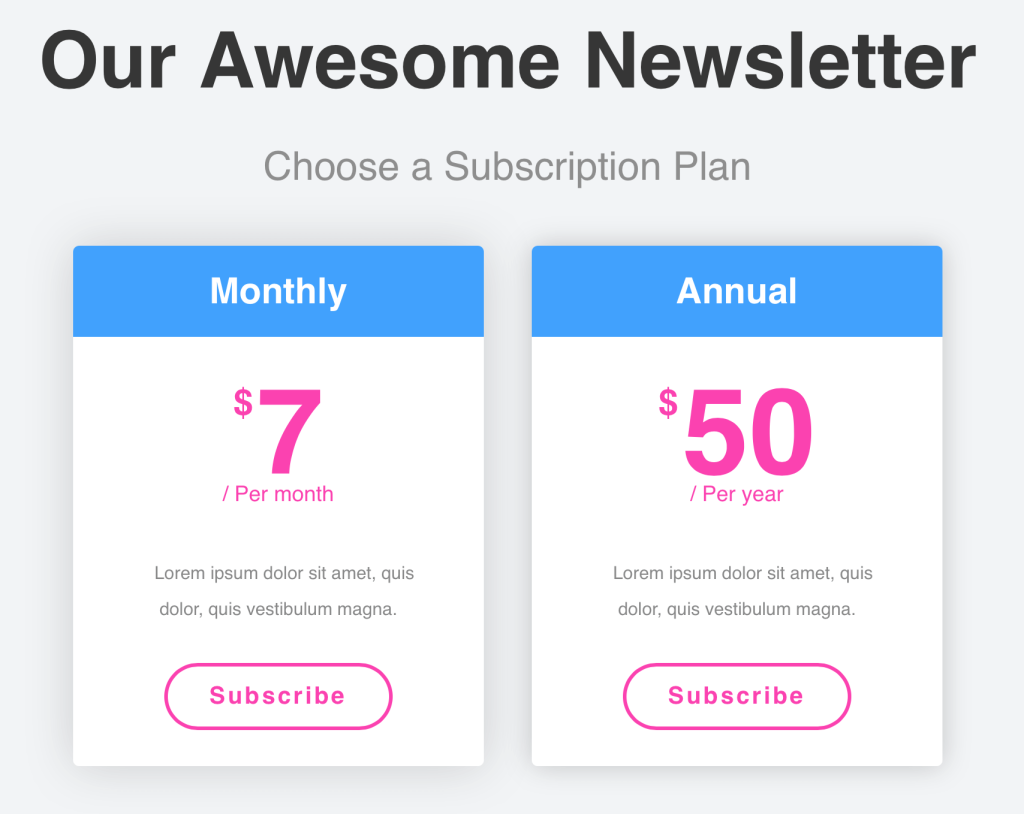

Fixed Subscriptions

This is the simplest form of recurring payment, where customers pay a fixed amount regularly. Whether it's monthly, quarterly, or annually, this model offers predictability and ease of manage recurring billing.

Usage-Based Models

This model charges customers based on their usage levels. It’s ideal for services where consumption can vary significantly, such as utilities or cloud storage services.

Tiered Subscriptions

Businesses that offer recurring payment solutions might use tiered subscriptions to provide different levels of service or product access at varying price points. Customers can choose a tier that best fits their needs and budget, making it a flexible option for both users and businesses.

Each model has its specific application and can be integrated using different payment processors that support recurring payment processing via credit or debit card or bank account deductions. Choosing the right model involves understanding your customer's preferences and payment capabilities, ensuring a seamless fit into your overall recurring payment model.

Benefits of Accepting Recurring Payments

Adopting recurring payments brings several substantial benefits to businesses aiming to stabilize and grow their revenue streams:

Improved Cash Flow

Regular and predictable payments from subscriptions help ensure a steady cash flow. This is vital for budgeting and financial planning, reducing the uncertainty of one-time transactions.

Customer Retention

Recurring payment systems make it convenient for customers to continue their services without the need to repeatedly accept payments manually. This ease of use significantly boosts customer retention rates.

Predictable Revenue

With recurring billing, businesses can forecast future revenue more accurately, which is crucial for long-term planning and investment. Knowing your expected income can help in making more informed decisions regarding business expansion and resource allocation.

These benefits highlight why many businesses are moving towards models that accept recurring payments and manage recurring billing. This transition not only supports financial stability but also enhances customer satisfaction by providing a hassle-free payment experience.

What Types of Payments Can Be Setup As Recurring? [Monetization Ideas]

We bet, you have lots of monthly automatic payments yourself - gym membership, streaming services, app subscription, utility bills, etc.

There're other types of subscription services you might consider setting up for your business. These popular types include:

Valuable Products

They operate on a simple yet effective premise – providing customers with access to valuable products, content, or online services in exchange for regular payments. Companies like Microsoft (with Office 365), Adobe (with Creative Cloud), and Salesforce offer software solutions on a subscription basis. This allows businesses and individuals to access the latest features and updates without the upfront cost of purchasing software licenses.

Even your newsletter can be considered a valuable product and can be paid for with recurring payments.

Exclusive Community

There's a wealth of groups and communities where you can connect with like-minded professionals. The broader your niche, the more communities you'll find yourself engaging with. Slack stands out as an excellent illustration of a platform where users successfully monetize their communities.

This surge in demand for premium content presents an opportune moment to consider launching your own paid membership digital community.

Educational Materials

E-books, membership blogs, and online courses require significant time and resources to create. Have you considered implementing recurring payments, allowing your users to pay for monthly access to these valuable resources? This not only enhances their exclusivity but also provides you with an additional income stream.

Subscription Boxes

From beauty products and gourmet foods to books, fitness gear, and pet supplies, there's a subscription box for virtually every interest. With recurring payments, you can rely on a consistent cash flow, making it easier to manage and grow your business. This predictability allows you to plan and invest in scaling your subscription box offerings.

Final Words

Implementing monthly subscriptions and an automatic payment method is a strategic move that not only streamlines the billing process but also promotes a hassle-free experience for both you and your customers.

As you can see, it's a no-brainer to automate credit card payments. Consider setting up a reliable system for subscription payments to establish consistency and predictability in your revenue stream.

Furthermore, the convenience offered by automatic recurring payments enhances customer retention as it reduces the friction of manual payments and fosters long-term loyalty. Embracing this approach demonstrates your commitment to accommodating customer preferences and simplifying their interactions with your brand. Embark on this journey to transform your billing cycle!