Imagine stumbling upon insights that could skyrocket your business growth. Well, that’s the power of a well-executed market research survey. For starters, you can consider conducting market research to understand the pulse of your target.

In this piece, we’ll dive into getting started with a market research survey that includes examples, understand its implications in marketing strategy, and check out our online survey maker, which can greatly help.

Why Do You Need a Market Research Survey?

Market research is a long-proven method for any business strategy, helping companies understand customer preferences, emerging trends, and potential market gaps. Such surveys are instrumental in collecting quantitative and qualitative data that act as the lifeblood for data-driven decision making.

These surveys are especially critical for firms that adopt the principles of revenue marketing where every marketing effort is linked to revenue generation and the focus is on resource optimization. In revenue marketing, the data from these surveys can provide the granular insights that help in optimizing campaigns and ensuring that resources are used to achieve a tangible ROI.

For instance, if a market survey identifies a product feature as highly desired among a target demographic, revenue marketing strategies can have the sales and the marketing team emphasizing this newly revealed feature in advertising campaigns, thereby enhancing the chances of conversions and sales.

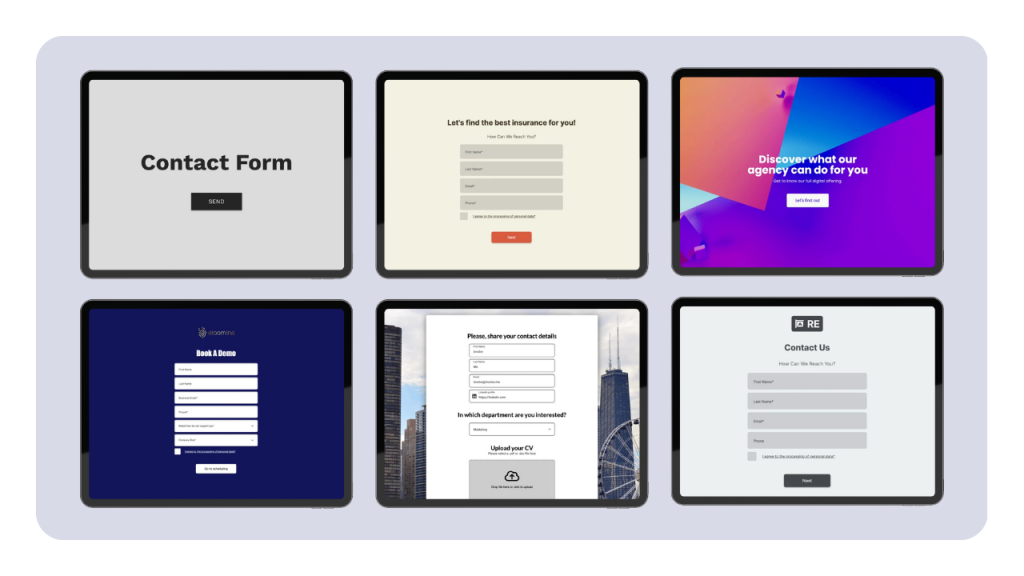

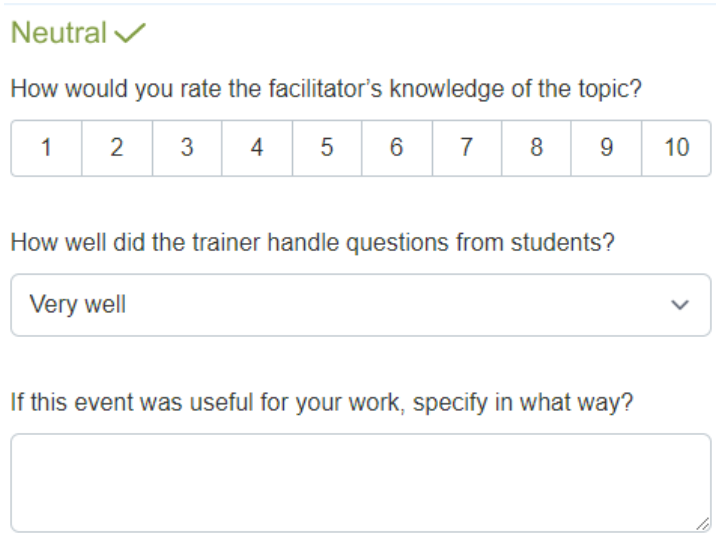

Here's an example of market research survey:

Grab this customisable template to create a similar survey.

Moving Beyond the Traditional Means of Survey Distribution

Traditional survey distribution, though tried and tested, often needs to improve in a world where people have access to multiple touchpoints and communication channels. Therefore, capturing a representative snapshot of consumer sentiment requires venturing beyond the conventional and embracing a more holistic approach to survey dissemination.

Here are some of the ways to distribute market surveys:

Multi-platform: This is where you can think of integrating email, social media, websites, and even SMS. It requires tailoring your message for each platform to address specific users to seek inputs to ensure maximum participation.

Pro Tip: Consider integrating security & compliance for data collected through market research for strict adherence to data protection regulations like Europe's General Data Protection Regulation (GDPR).

Explore qualitative platforms: Beyond the standard online survey platforms, consider face-to-face opportunities, especially if your survey benefits from deeper conversations. Also, other methods like focus groups, interviews, and workshops provide nuanced insights.

Strike a partnership and collaboration: Work with businesses or organizations that share your target demographic but aren’t competitors. This way, you can take your survey to a new audience to widen your reach.

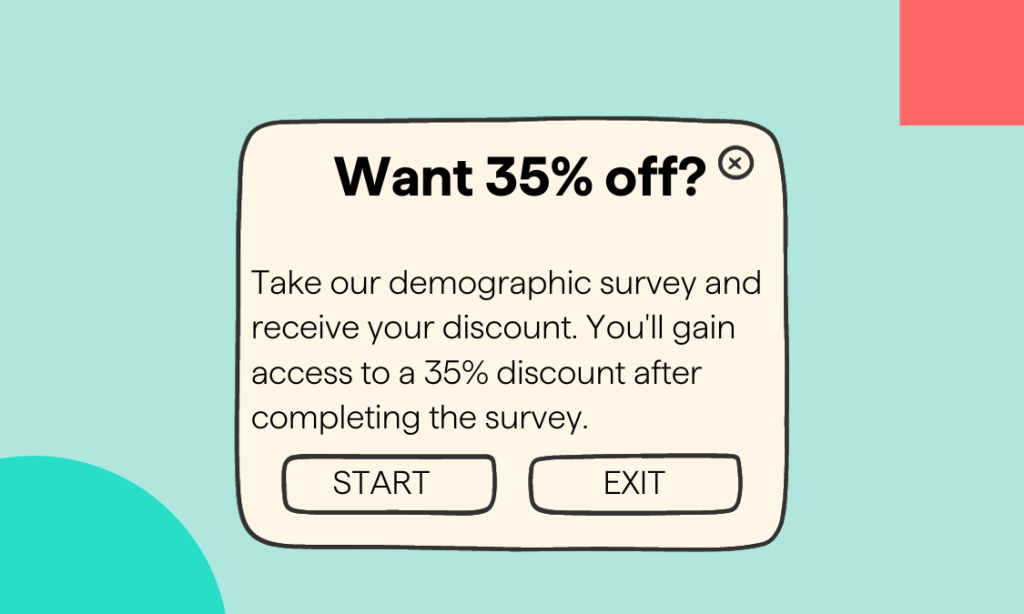

Incentivize participation: Consider offering an incentive for completing the survey. One way is to market the survey with upfront incentives promised over email and social media campaigns. However, in-depth participation, like interviews, requires revealing incentives at the end to ensure genuine responses.

incentive for completing the survey

Let's explore more on it to ensure maximum survey participation.

Motivating Respondents for Maximum Participation

Top-notch market research requires quality and quantity of responses while addressing their primary needs to motivate them.

More than just reaching out to the people, it is about reaching out in a way that resonates. Therefore, consider what motivates your respondents or how to engage with your target audience. This needs clear communication, respect for their time, and an understanding of their intrinsic motivations.

Let's dig in more.

Offer a clear value proposition: Begin by communicating the benefit of participating in your market survey. If the survey concerns quality, tell them their feedback will lead to better products or services. The opportunity to shape a brand they care about can motivate them.

Time sensitivity: Use limited-time offers to encourage immediate participation in a market survey. For instance, entice your regular customers with a catchy offer like “Complete this survey in the next 48 hours and get 20% off across the site.”

Gamification: Transform your survey into an engaging experience like quizzes, points, or badges. This can enhance the participation rates, especially with younger audiences, since traditional surveys don’t interest them.

Feedback loop: Always go back to your respondents once they provide inputs. After completing the survey, communicate your findings and actions based on collective responses. When participants see their input having an effect, they’re more likely to engage in the future.

Crafting the Right Questions

When creating a market survey, you want to ensure that questions are framed to get answers that help decision-making. Let's check out some tips.

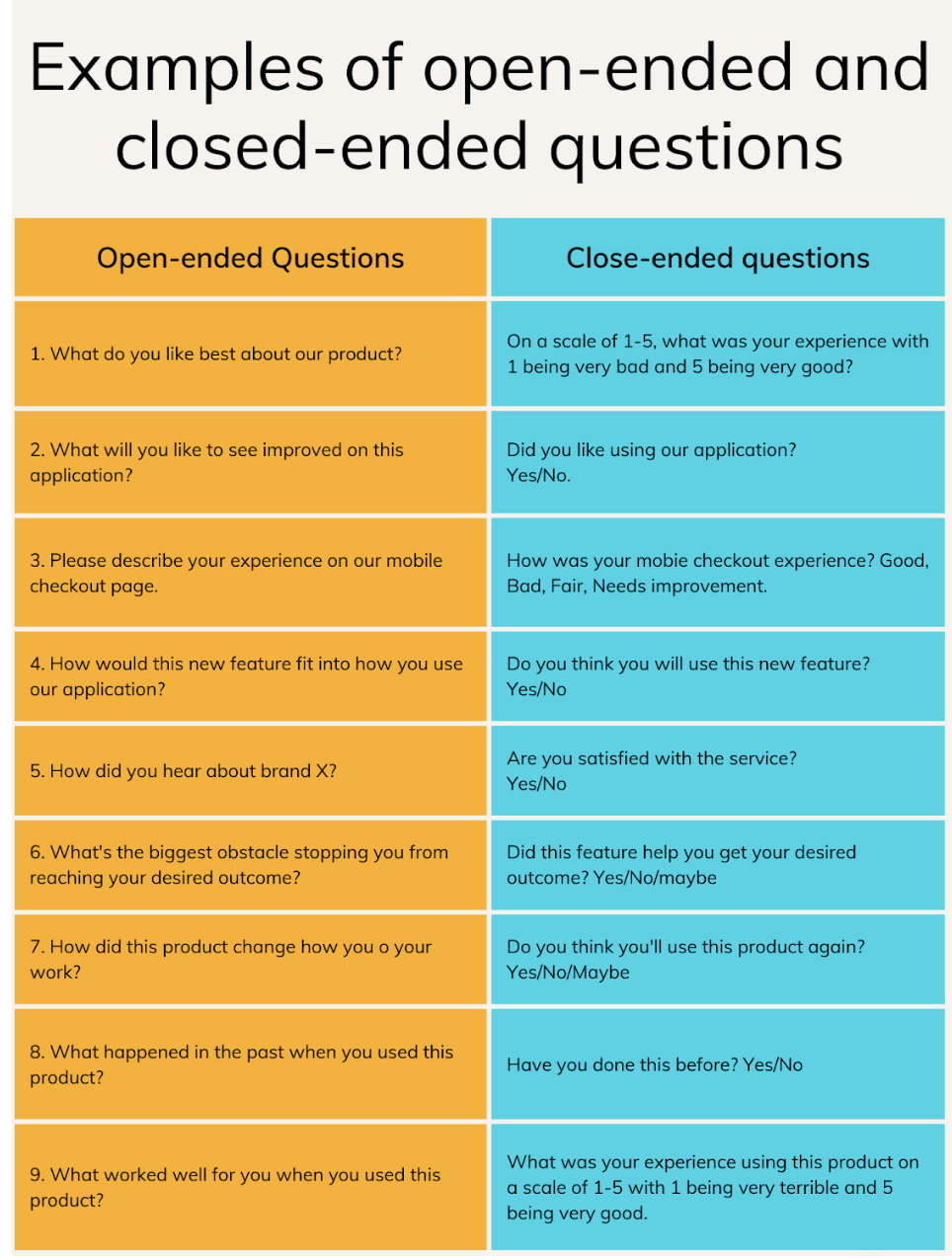

Strike a Balance Between Open-ended and Closed-ended Questions

Frame open-ended questions that invite respondents to share detailed answers in their own words. Example: "What features would you like to see in our next product update?"

On the other end, closed-ended questions provide predefined answers for respondents to choose from. They're quicker to answer and easier to analyze but (may) limit the scope of responses. Example: "How frequently would you want to hear from us? Weekly / Fortnightly / Monthly."

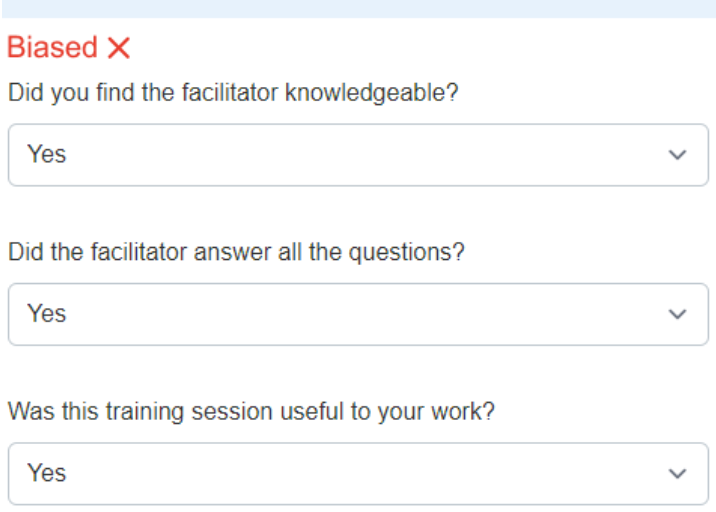

Avoid Pitfalls of Leading and Biased Questions

Leading and biased questions can severely skew your results, so avoid common mistakes when asking them.

Leading questions subtly prompt the respondent towards a particular answer. For instance, "Don't you think our latest product is revolutionary?" implies a positive answer.

Conversely, biased questions are framed to showcase a clear preference for one answer. "Is it hard dealing with our incredibly advanced software?" positions the software as "incredibly advanced," which may not be the respondent's perspective.

Avoiding such pitfalls requires striving for neutrality in phrasing questions.

To ensure brevity, opt for a neutral third party to review your questions as a solution.

Examples of Questions to Include in a Market Survey

Let us check out some key questions you can consider when creating a market survey.

On a scale of 1-10, how likely are you to recommend our products/services to someone?

This is a classic example of a question to gauge net promoter score (NPS). The NPS is a common metric to gauge customer loyalty and satisfaction, wherein a high score indicates that your product or service offers better customer satisfaction to the extent of becoming a brand ambassador. Conversely, a low score could highlight customer experience issues needing some attention.

Rank the factors that influence your purchasing decisions (price/quality/brand reputation/recommendations)

You can ask this question to understand what primarily motivates the customer's decision to purchase. For example, if most responses indicate "price" as their main factor, you can reconsider your pricing strategy or offer more value-based propositions.

What are some improvements to enhance our website or app?

This is the question where you seek user experience (UX) feedback, design, and functionality. Answers to this will provide actionable insights for technical teams since direct feedback helps prioritize features or areas of improvement.

What is the one thing that you’d want to change about the product?

Asking this question can help pinpoint a missing feature, a design flaw, or other pain point. Feedback on this question is invaluable for product development teams as they can address pressing issues and refine products to meet customer expectations.

Choose the Survey Medium

Choosing the right survey medium is as critical as crafting the right questions when embarking on a market research journey. The medium you select can influence response rates, the answers' depth, and the data's quality.

Let's delve into the various mediums available and weigh their pros and cons.

Online Platforms

Digital tools enable surveys to be created, disseminated, and filled out online. For instance, you can use our survey maker (more on it later) to start collecting customer data that aids in building custom profiles.

Pros

Easy to scale with a capacity to reach a wider audience cost-effectively.

Enables real-time data collection and analysis.

It is easy for respondents as it helps them complete the survey at their own pace.

Cons

It can only reach those who have internet access.

Deprive respondents of the personal touch, leading to lower completion rates.

Risk of getting data if shared in echo-chamber communities.

Face-to-face Interviews

This is a traditional survey method of in-person conversations where a researcher asks questions directly to respondents, which can pave the way for deep and qualitative insights.

Pros

Provides depth, allowing follow-up questions based on respondents' answers.

Help collect more data through non-verbal cues and observations.

Typically, there are higher completion rates as it's more personal.

Cons

A time-consuming and more expensive process.

It has geographical limitations.

Chances of interviewer bias.

Telephone Surveys

This survey method is conducted over the phone with researchers in a position to offer a more personal touch than online surveys and overcome limitations of geographical boundaries.

Pros

It can reach a broader demographic since it reaches those unavailable online.

faster than face-to-face interviews.

Help the researcher add a personal touch.

Cons

Some respondents may consider it as intrusive or annoying.

Limited time as respondents may need more patience.

A lot depends on the respondent's availability.

Focus Groups

This is a form of qualitative research where people in the group discuss a particular topic or product under the guidance of a moderator, in turn providing rich, interactive insights.

Pros

It helps in-depth discussions and diverse perspectives on a topic.

It aids the researcher in observing group dynamics and consensus-building.

Useful for testing reactions to new concepts or products.

Cons

It is an expensive and time-consuming process.

The dominant voices may overshadow others.

The findings may not provide an accurate picture due to the smaller group size.

Using involve.me Online Survey Maker

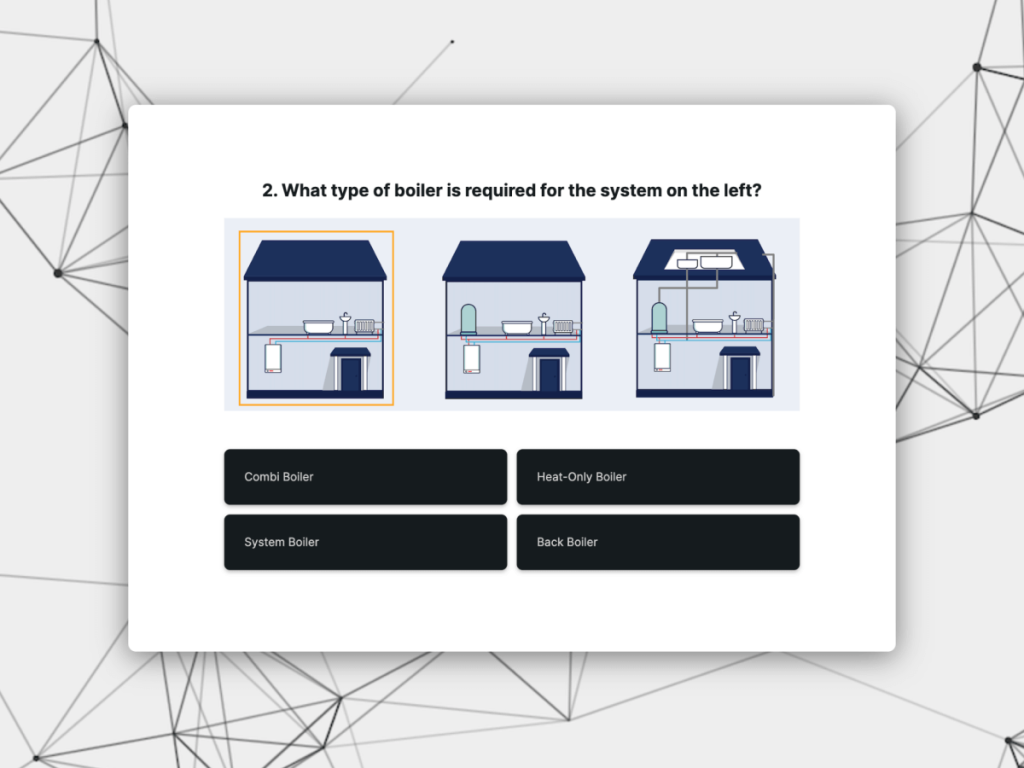

With the evolution of digital tools, you should also consider picking up the best survey tools that help create and disseminate surveys. With involve.me, you can create a range of content, including surveys, quizzes, polls, and other interactive activities for users.

Create Interactive Content

Start with a customisable template

360 Employee Survey Template

Customer Satisfaction Survey for Finance Template

Opinion Scale Survey for Energy Industry Template

Welcome Survey Template

Subscription Box Customer Service Template

Opinion scale survey for legal services Template

Leverage its easy-to-use, drag-and-drop interface that enables editing and customizing layouts. You can also use features like automated scoring, multiple language support, email alerts on survey completion, user tracking across projects, and integration with Google Tag Manager.

Why should you use involve.me survey maker?

It allows for visually appealing survey designs, boosting engagement.

A range of integrations with various tools and platforms enables smoother data management.

You can use its built-in AI-powered analytics to summarise survey responses.

Wrapping Up

Consider all the factors and activities we discussed before you go all guns blazing for a market research survey. An effective approach will thus begin with crafting precise objectives, framing questions that provide genuine insights, and opting for a suitable medium for target customers.

Moreover, you’d need to ensure data security and compliance by adhering to global regulations that enhance trust among respondents. While traditional face-to-face interviews and focus groups offer in-depth insights, their downsides may far outweigh their positives. Therefore, digital tools like involve.me can help you drive market research surveys, making them efficient and scalable.

Ultimately, the key is to align the survey's design and method with your audience's preferences and the data you seek based on your survey objectives.

Author

Carl Torrence is a Content Marketer at Marketing Digest. His core expertise lies in developing data-driven content for brands, SaaS businesses, and agencies. In his free time, he enjoys binge-watching time-travel movies and listening to Linkin Park and Coldplay albums.