As financial advisors, we constantly seek effective strategies to attract potential clients. With myriad options available, from automated tools like email marketing and chatbots to proactive efforts such as strategic partnerships and cold calling, the question arises: which methods actually work for the finance industry?

This post is designed to cut through the confusion and offer a concise overview of the top lead generation techniques tailored to financial advisors:

1. Call Your Valuable Leads

Cold calling remains a timeless strategy for financial advisors aiming to generate leads.

In today's remote work environment, contacting prospects on their mobile phones is highly effective. This shift from office landlines to personal numbers greatly improves the chances of connecting with potential leads.

Here's a quick guide to improving your cold calling success rate:

Research your prospects: Use LinkedIn and other resources to learn about your prospects before calling. This helps personalize your approach. LinkedIn research indicates that mentioning a shared LinkedIn group at the start of a sales call can increase the chances of securing a meeting by 70%.

Call at the best time: Identify when your prospects are more likely to be available and receptive.

Prepare a script: While scripts should guide the conversation flow, they shouldn’t be followed rigidly. Personalize your approach.

2. Establish Trust by Providing Value

Focus on providing real value through these strategies:

Offer it for free:

Publish informative blog posts that tackle common financial issues.

Host free webinars or podcasts on relevant financial topics.

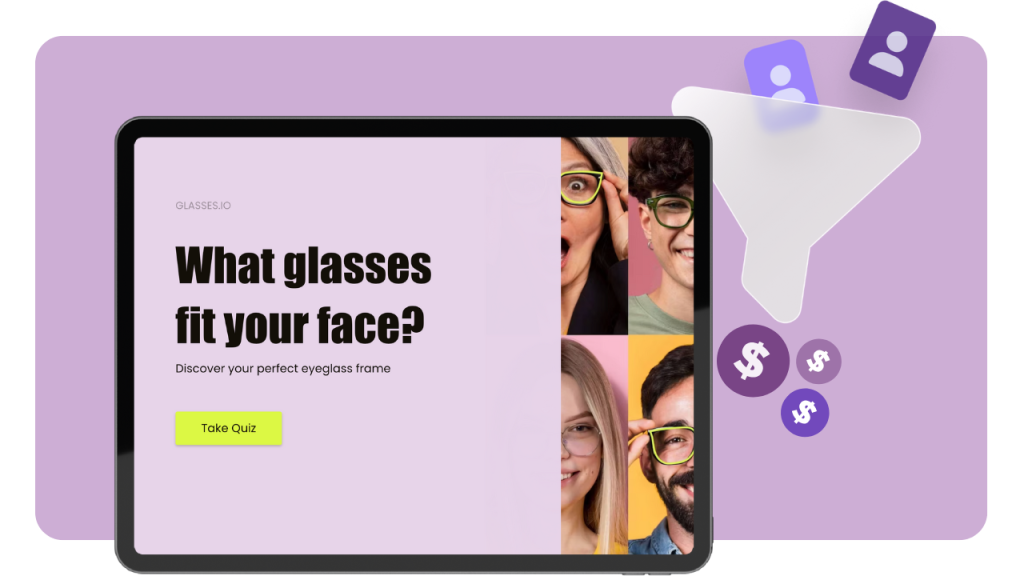

Create free interactive tools like budget calculators or risk assessment quizzes for your website.

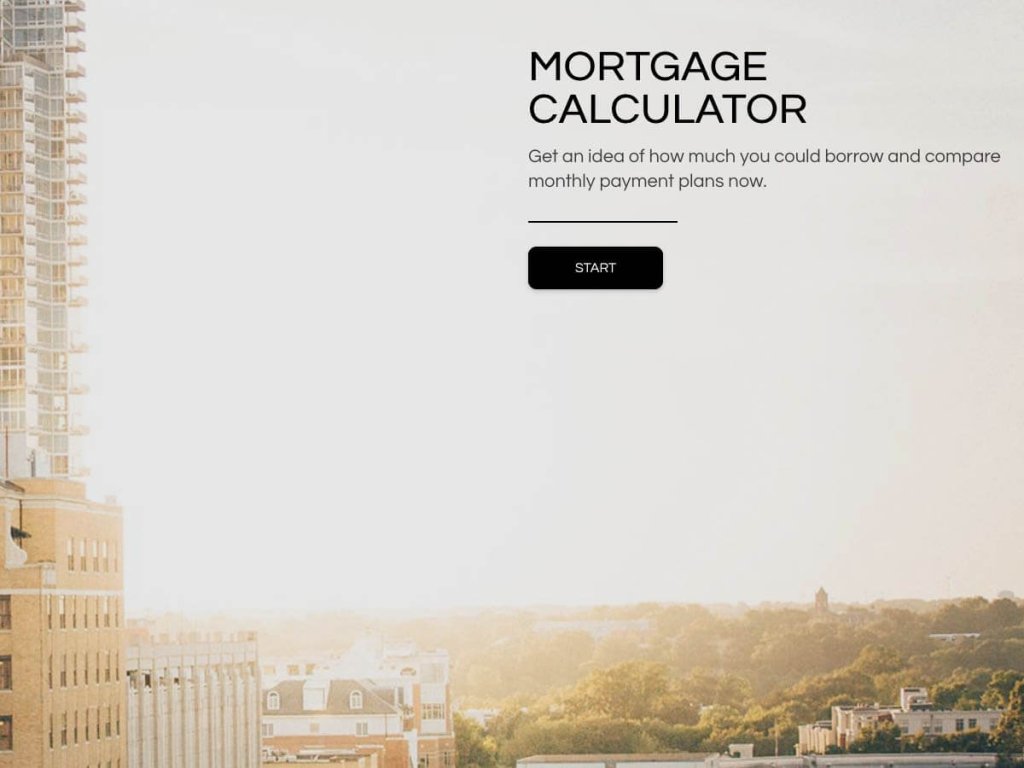

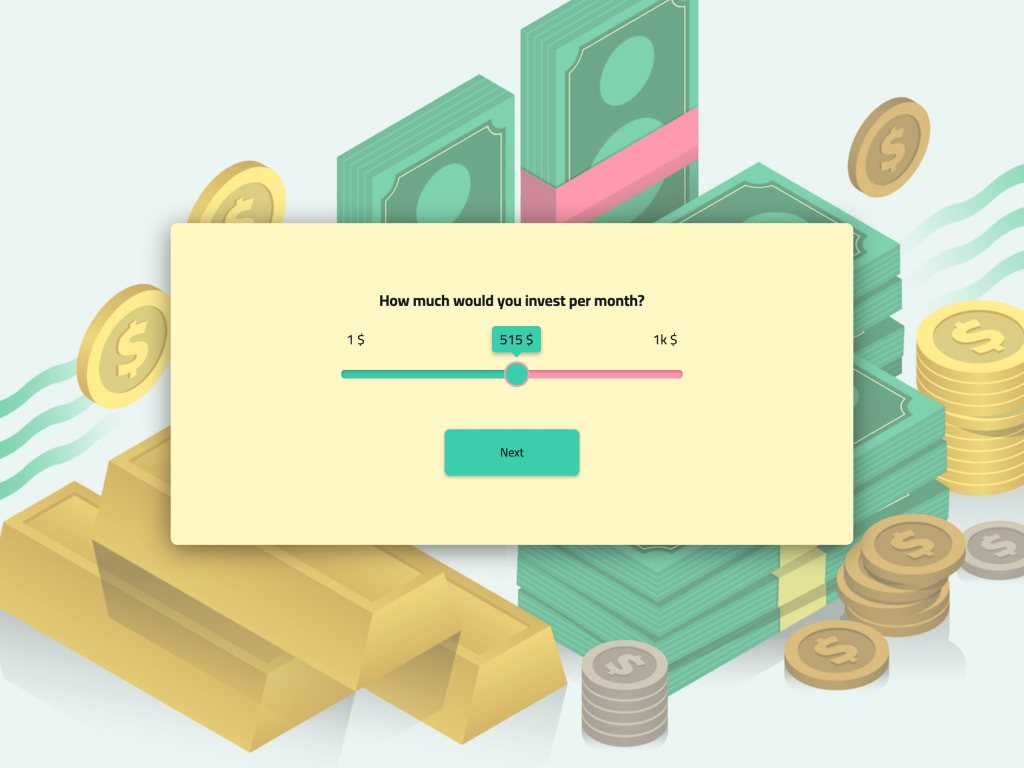

Here's an example of a free tool you can create on your own:

Read this guide for creating various types of free website tools, similar to the example provided above.

Create lead magnets:

Use pre-designed financial templates as lead magnets to attract potential leads. By offering immediate value in exchange for their contact information, you can draw them in and initiate a valuable relationship.

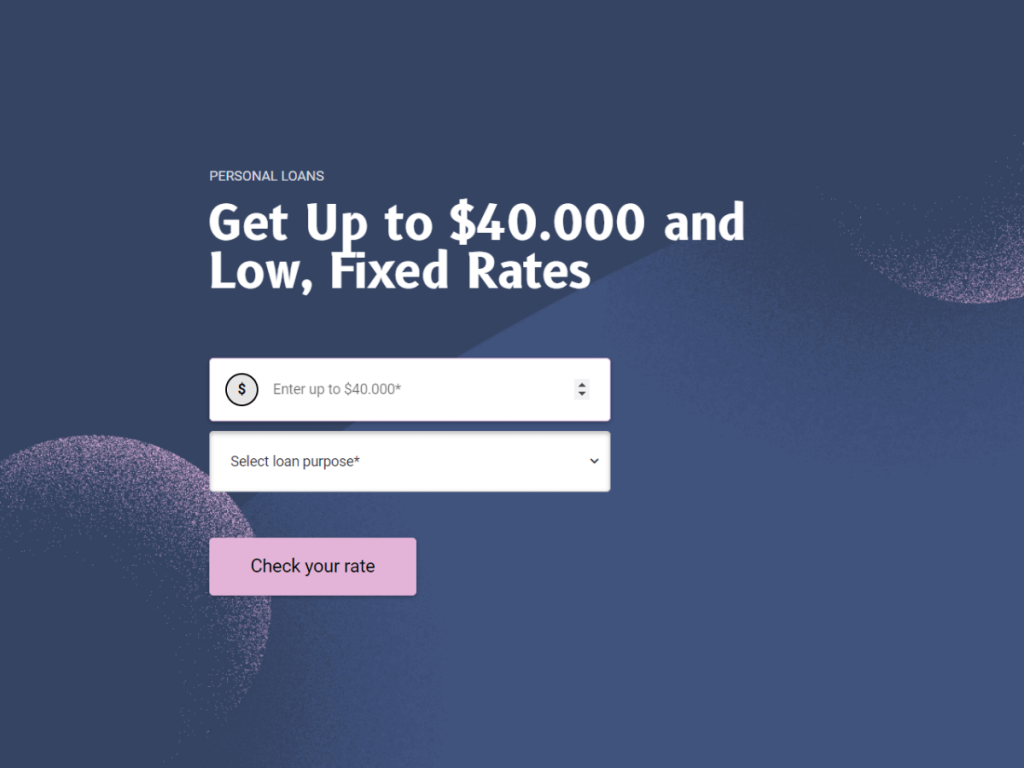

Collect leads with pre-designed templates

Customize the forms as you like!

3. Reverse Engineer Social Media

Engage strategically with your target audience. This involves a detailed understanding of your audience through comprehensive market research to identify what captures their interest.

Key steps for audience understanding:

Analyze existing customers: Gather insights on demographics, behaviors, and preferences from sales data, online analytics, and direct feedback.

Evaluate competitors: Understand competitors' audiences to discover market gaps or overlaps.

Develop buyer personas: Create detailed representations of your target audience segments based on collected data to tailor your marketing efforts.

Exclude non-targets: Identify who your product or service does not cater to, focusing your marketing on the most promising prospects.

4. Email Marketing

Email marketing and paid advertising are powerful strategies for financial planners to generate qualified leads efficiently. Key steps include:

Automate segmented drip campaigns: Direct personalized emails to segmented leads based on their interests—retirement planning tips for some and market updates for others seeking quick wealth growth.

Purchase targeted email lists: Opt for verified and compliant email lists tailored for financial advisors. Avoid low-cost providers offering outdated or non-compliant lists.

This approach ensures your messages are relevant and timely, building trust with potential clients and increasing the likelihood of converting them into paying customers.

5. Build a Personal Brand

For financial advisors looking to attract new clients, building a personal brand is crucial. By becoming known as an expert in your field, whether it's wealth management, financial planning, or another area of finance, you'll naturally draw in leads who see you as the go-to authority. Here's how to do it effectively:

Identify your platforms: Start with LinkedIn and Facebook, as your target audience is most active on these platforms.

Regular engagement: Post consistently on these platforms. Your content should cover topics relevant to your audience's interests, such as investment strategies, personal finance tips, and industry insights.

6. Cultivate Leads Through Current Clients

Encouraging leads through existing clients is a smart strategy for financial professionals aiming to expand their advisory business. Alvin Carlos, a certified financial planner, stresses the importance of directly asking current clients for referrals.

Some clients may not naturally think to refer others, so it's vital to communicate your goal—such as aiming to help 10 new clients this year—to them. This approach showcases your dedication to adding value to those you serve and establishes a sustainable cycle of lead generation, as these new clients may also refer others in the future.

Regularly mentioning your need for referrals in communications, such as email newsletters, is a simple yet effective way to remind clients that you're actively seeking to assist new individuals. By leveraging existing relationships, you can secure future business growth.

7. Monitor Competition

Keeping an eye on your competition is a vital strategy for financial advisors looking to better understand and reach their target audience. Similar to how athletes study their opponents to enhance their performance, financial advisors can gain valuable insights by observing their competitors.

This goes beyond merely taking note of their actions; it's about comprehending why certain strategies are effective and how to apply those lessons to your own services.

For instance, analyzing a competitor's LinkedIn profile allows you to evaluate the content they share and the level of engagement they generate. One practical tool for this analysis is the Kleo extension, which can help identify your competitors' best-performing posts.

8. Local SEO

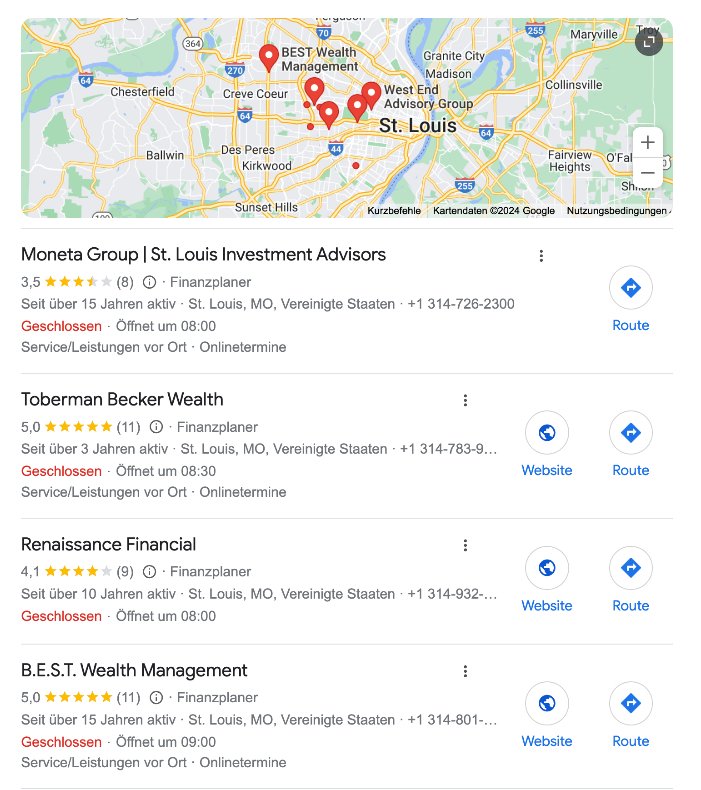

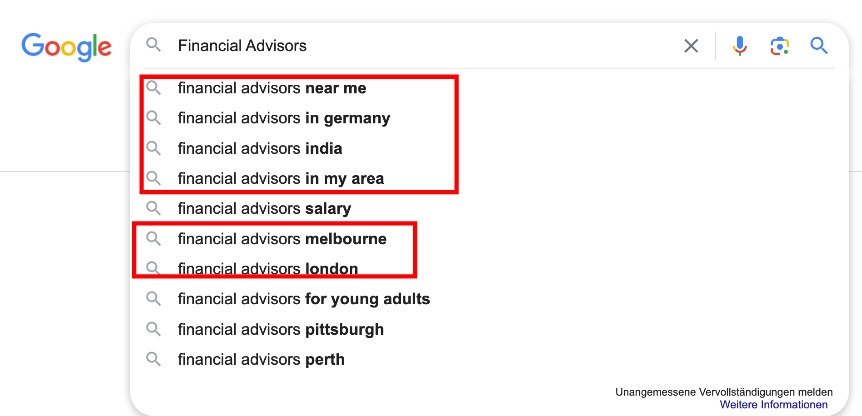

Boosting your financial advisory firm's visibility through local SEO is a powerful way to attract potential clients searching for nearby services. Unlike traditional SEO, which casts a wide net, local SEO targets location-based searches, ensuring that your business shows up in relevant local queries.

Here's a detailed guide on how to make the most of local SEO:

Google My Business (GMB) Optimization

The cornerstone of Local SEO lies in establishing and optimizing a Google My Business (GMB) page, which acts as the main point of interaction on Google for local businesses.

Make sure all information on your GMB profile is complete and correct to boost visibility and instill trust. Keep your profile fresh with regular updates through Google Posts, respond promptly to reviews, and encourage clients to leave feedback. This not only improves your ranking but also enhances your credibility.

Importance of Accurate Listings

Ensuring accurate and consistent listings across the web, spanning directories and social media platforms, is essential. This practice helps search engines confirm your business's location and services.

The effect on search results: Inconsistent or inaccurate NAP (Name, Address, Phone Number) information can result in diminished visibility or the display of incorrect business details.

Driving Diverse Traffic

Local SEO isn't just about boosting physical visits; it also targets diverse forms of local engagement, such as calls, website visits, and online reviews.

Successful local SEO reaches customers at various stages of their search journey, whether they're seeking contact details, service information, or user feedback.

Online Ratings and Reviews

Reviews play a substantial role in search rankings and shape potential clients' perceptions. Positive reviews can notably enhance your visibility in local search results. Proactively handling and responding to online reviews showcases client engagement and holds sway over your business's online reputation.

Mobile Optimization

Considering that a considerable 69% of local searches are conducted on mobile devices, it's crucial to ensure your website is mobile-friendly to effectively reach this audience.

As you can see, most of the searches for financial advisors are local.

Final Thoughts

In summary, adopting a blend of traditional and digital strategies is essential for financial advisors aiming to grow their client base and generate leads effectively. Whether it's harnessing personal branding and email marketing or reverse-engineering social media tactics and optimizing for local SEO, each approach provides a distinct avenue for attracting qualified leads.

Putting these strategies into action, as illustrated by tangible examples like developing a robust Google My Business page, not only boosts visibility but also fosters trust and authority within the financial advisory realm.

Collect leads with pre-designed forms

Cusomize the forms as you like!

Author

Josef Mohamed, an SEO Marketer and Content Strategist. Founder of Blissa.de and manage SEO for multiple big names. You can find him on josefmohamed.com.